Property is among the most well-liked choices between SDIRA holders. That’s due to the fact it is possible to put money into any sort of housing by using a self-directed IRA.

IRAs held at banks and brokerage firms offer confined investment solutions for their shoppers since they would not have the expertise or infrastructure to administer alternative assets.

Indeed, housing is among our purchasers’ most popular investments, in some cases named a housing IRA. Customers have the option to speculate in everything from rental Houses, industrial housing, undeveloped land, mortgage notes plus much more.

Variety of Investment Selections: Make sure the company lets the categories of alternative investments you’re keen on, for instance real estate property, precious metals, or personal equity.

In some cases, the costs related to SDIRAs could be increased plus more complex than with an everyday IRA. This is because in the elevated complexity related to administering the account.

Complexity and Responsibility: With an SDIRA, you might have much more Handle around your investments, but You furthermore may bear far more accountability.

A self-directed IRA can be an very impressive investment car or truck, but it surely’s not for everybody. As being the saying goes: with terrific ability will come terrific duty; and with the SDIRA, that couldn’t be a lot more accurate. Keep reading to learn why an SDIRA may possibly, or won't, be for you personally.

Several buyers are astonished to learn that utilizing retirement funds to speculate in alternative assets has long been probable since 1974. However, most brokerage firms and banks deal with presenting publicly traded securities, like stocks and bonds, given that they lack the infrastructure and know-how to control privately held assets, like housing or personal fairness.

Set basically, in the event you’re hunting for a tax efficient way to create a portfolio that’s additional personalized for your pursuits and knowledge, an SDIRA can be The solution.

Ahead of opening an SDIRA, it’s vital that you weigh the likely pros and cons depending on your precise fiscal ambitions and hazard tolerance.

Opening an SDIRA can present you with use of investments Commonly unavailable by way of a lender or brokerage organization. Here’s how to begin:

Adding income on to your account. Bear in mind contributions are issue to once-a-year IRA contribution restrictions established via the IRS.

Consider your Mate may very well be starting off the following Fb or Uber? Having an SDIRA, you check my site can spend money on brings about that you suspect in; and probably love larger returns.

Entrust can guide you in paying for alternative investments together with your retirement funds, and administer the purchasing and promoting of assets that are typically unavailable via banks and brokerage firms.

Because of this, they have an inclination not to advertise self-directed IRAs, which supply the flexibleness to speculate within a broader number of assets.

Ease of Use and Engineering: A person-pleasant System with online tools to trace your investments, submit navigate here paperwork, and handle your account is very important.

Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the goal of building fraudulent investments. They typically idiot buyers by telling them that When the investment is acknowledged by a self-directed IRA custodian, it need to be legitimate, which isn’t correct. Once again, You should definitely do complete homework on all investments you end up picking.

Going funds from just one type of account to another form of account, which include shifting money from a 401(k) to a traditional IRA.

Once you’ve located an SDIRA service provider and opened your account, you might be thinking how to actually get started investing. Knowing both of those the rules that govern SDIRAs, together with how you can fund your account, can assist to put the muse to get a future of prosperous investing.

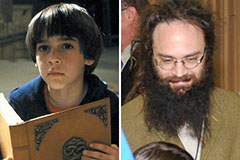

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!